Everything You Need to Know About the CIBIL Score Check

CIBIL score check? CIBIL score plays an essential role in assessing loan or credit card applications. Without a good CIBIL score, the lender might not give you a loan to make big financial purchases like buying a home or covering consolidating debt and emergency expenses. Therefore, it is important to have a good CIBIL score to qualify for the loan. But what is a good CIBIL score? Read the blog to learn about good CIBIL scores and how to perform a CIBIL score check.

What Is The Meaning Of CIBIL?

The Credit Information Bureau India Limited (CIBIL) was established in 2000. This provider handles credit-related tasks like loans or credits. The registered banks provide CIBIL with full credit data. The CIBIL generates a Credit Information Report (CIR) based on the analysis that displays each applicant’s credit score. The CIBIL is a credit information database that is made available to banks and lenders so they may efficiently perform a CIBIL score check.

Who Are The Shareholders Of CIBIL?

The shareholders in CIBIL include the following banks:

- State Bank of India

- Bank of Baroda

- Allahabad Bank

- Bank of India

- Union Bank of India

- Industrial Credit and Investment Corporation of India

- Hongkong and Shanghai Banking Corporation

- Indian Overseas Bank

What Does A CIBIL Score Imply?

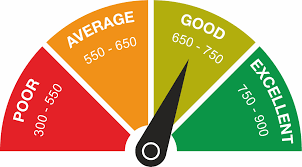

TransUnion CIBIL computes a CIBIL score for every applicant based on their credit activity. It is a three-digit CIBIL score given to the applicants based on how good or bad they have maintained financial discipline. In other words, an applicant gets a CIBIL score between 300 to 900 based on whether they have a good or bad credit history. Applicants can get their CIBIL score check every once in a while to ensure they have a good score.

What Score Is Considered A ‘Good’ Score In CIBIL?

With the CIBIL score range being 300 to 900, 300 is considered the lowest, and 900 is the highest score. A score of 700 is an average score. Therefore, applicants should have a target of achieving between 700 to 900 CIBIL scores. If an applicant doesn’t repay the loan on time, utilizes less credit, and does not close old credits, the CIBIL score can be affected. Thus, maintaining these is important to stay close to a good CIBIL score.

What Are The Advantages Of A Good Credit Score?

The benefits of having a good credit score are as follows:

- With good credit behavior, you’ll have a higher chance of getting a loan from the lender.

- You can get access to premium credit cards with a good score.

- You’ll get a comparatively low rate for a home or personal loan.

- You’ll get the best rates for homeowners or car insurance.

What Are The Factors Considered For Score Calculation?

The organization considers certain factors for calculating the CIBIL score.

- Payment Behavior: If an applicant misses a payment or delays it, the score can get affected.

- Outstanding Debt: The organization deducts marks during the CIBIL score check if unpaid dues reflect on the credit report.

- High Credit Utilization Ratio: According to experts, using 30% of the credit limit is ideal. So, the score can be reduced if you spend more than this ratio.

- Length of Credit History: The duration of credit history is also calculated during the CIBIL score check.

- Credit Mix: The score can decrease if you don’t have a healthy mix of secured and unsecured loans.

How To Improve CIBIL Score?

If you have a low score and are wondering how to improve CIBIL score, there are many ways to do it. You can increase the score by maintaining the credit utilization ratio, balancing unsecured and secured loans well, and paying the loans on time.

Conclusion

Now you know everything about CIBIL score check, the advantages of having a good CIBIL score, and how you can improve the score if you have less than the average score. So, try maintaining a good CIBIL score from today and get loans easily for your financial need.

Also read: streameast com